Aloha Providers!

The Supplemental Child Care Grant Program has ended. If you do have questions, please reach out to childcaregrants@dhs.hawaii.gov

Mahalo!

Program Details

SUPPLEMENTAL CHILD CARE GRANT PROGRAM

Round Two: Supplemental Child Care Grant Program

Overview

Due to a surplus of funding, it has been decided that those providers who applied for and were eligible for funding through the Supplemental Child Care Program will be eligible for a second payment. No new applications will be accepted. This additional funding is only for previously approved providers.

Process and Timeframe

From July 1 - July 19th, approved providers will need to update their existing application in order to receive a second payment. Providers will be asked to confirm all staff entered on their original application are still employed. Providers will not be able to add new staff. No other application updates are required.

Use of Funds

Providers will be able to use these additional funds as outlined in the original round of funding -- there are no changes to permissible fund usage.

Award Information

Providers will receive both an operational base award and staff retention bonuses in this payment.

Operating Expenses Award

Similar to the first round of payments, operating awards will be calculated as a per-child amount based on service type and licensed capacity. The numbers below are estimated payments for Round 2. These may change based on final application numbers.

| Provider Type | Operating Expenses Award (Amount per Child) | |

|---|---|---|

| IT | Infant / Toddler Centers | $1,410.00 |

| GCC | Group Child Care / Preschool | $898.00 |

| FCC | Family Child Care | $1,218.00 |

| GCH | Group Care Home | $1,218.00 |

| BAS | Before / After School Programs | $207.00 |

| A+ | A+ Programs | $207.00 |

Staff Retention Award

Providers can also receive additional funds for staff retention efforts. Unlike the previous round of funding, all caregiving staff will receive a flat payment amount of $1,000. This will not vary by position. Staff are only eligible for the retention award if they were included and approved in the initial application. No new staff may be added to the application. Upon application approval, funding awards will be processed and distributed by Public Consulting Group (PCG) directly to the payment information provided via direct deposit. Payments will be disbursed in September 2024.

Reporting Requirements

All grant recipients are required to submit documentation for all spending, which should be uploaded throughout the grant period in the application portal. All grant recipients are also required to complete a DHS Final Report in the application portal by November 14, 2024.

Round One: Supplemental Child Care Grant Program

Overview

The State of Hawaii Department of Human Services has received funds through the American Rescue Plan Act (ARPA) of 2021 to provide assistance to licensed child care providers experiencing financial hardship and child care market instability due to COVID-19. Funds are intended to improve child care provider staff retention and recruitment efforts, and cover the financial obligations of continuing operations, preventing permanent closures, and/or enabling programs to reopen safely and with financial resources to Hawaii’s families.

Applications for a supplemental round of funding will be accepted beginning in January 2024 for the purpose of improving child care provider staff retention and recruitment efforts and providing a stable source of funding for operating costs for providers.

For answers to frequently asked questions, please reference the FAQ resource - here

Eligibility Criteria

To be eligible for this program, you must:

Required Documentation

Applicants will be required to provide the following documentation with their application:

Completed W-9 Form (blank copy here)Use of Funds

Grant funds may only be used for the categories listed below, for expenses incurred between October 1, 2023 and October 24, 2024. Any remaining unspent funds must be returned to the State of Hawaii Department of Human Services by November 7, 2024. Records and documentation will be required in order to prove the use of funds. Fund usage can be broken into two components: Operating Expenses and Staff Retention Expenses.

Operating ExpensesAward funds may be used to cover the following operating expenses:

*Because only a percentage of these expenses are used to run a business in your home, Family Child Care providers may only use a percentage of grant funds received for their mortgage, rent, utilities, etc. Providers may use a time/space percentage calculator to determine the number of hours and space the home is used for business activities.

Staff Retention Expenses

Providers can also receive an additional award component for all caregiving staff who are employed at the time of this application. This funding can be used for:

*Some portion of the Staff Retention Expenses award must be paid to each employee within 30 days upon receipt of the award payment to the child care facility. The remaining amount must be received by employees prior to the facility applying to receive the second half of the award.

If an employee resigns or is terminated before the child care facility receives the Staff Retention Expenses award, or if an employee leaves before receiving the entire Staff Retention Expenses award payment, the provider must return the remaining portion of these funds back to DHS within 30 days of the employee leaving.

Application Process

Click Apply Now on this page to start a new application. If you are responsible for more than one Provider, you will be able to submit an application for each Provider using the same login account. If your Provider includes more than one Site and/or Service, you will need to provide the relevant information for each Site/Service in order to successfully complete and submit your application. Partially completed applications will not be processed. THE SUPPLEMENTAL CHILD CARE GRANT APPLICATION IS OPEN THROUGH 11:59 P.M. FEBRUARY 9, 2024. ANY APPLICATION RECEIVED AFTER THE DEADLINE WILL NOT BE ACCEPTED.

Once you have clicked Save on Section 1 of the application, you can re-access your application at any time from the Manage Existing Applications page. You can also see the status of your application at any time from that page. Please see below for more details on the different application statuses.

After you submit your application, you will receive an email confirmation. Application review and processing may take several weeks. If we need any further information from you or need you to fix or update your application, we will send you a follow-up email with directions for logging back into the portal and viewing our specific follow-up request.

You will receive an email if your application is approved, which will detail award amounts by Site/Service, along with instructions for providing evidence later on about how you spent the funds.

| Application Status | Description |

|---|---|

| Draft | Application has been started but not submitted. |

| Submitted | Application and supporting documents are ready for processing. |

| Under Review | Application and supporting documents are processing. |

| Follow-Up | Additional information is requested and must be provided by the applicant in order to continue processing. |

| Awaiting Decision | Application has completed processing and is waiting for a final decision on approval or denial. |

| Denied | Application has been denied. |

| Pending Signature | Application has been approved for payment but pending the applicant’s signature for the acceptance letter shared via email. |

| Approved | Application has been approved for payment and applicant has signed the acceptance letter. |

| Processing Payment | Payment is being processed. |

| Paid | Payment has been distributed and accepted. |

| Cancelled | Application has been cancelled by the applicant. |

Award Details

If you are a licensed, regulated, or qualified exempt Child Care Provider, you may be eligible to receive a per-child amount based on service type and licensed capacity.

The formulas for the awards are as follows:

| Provider Type | Operating Expenses Award (Amount per Child) | |

|---|---|---|

| IT | Infant / Toddler Centers | $2,120.00 |

| GCC | Group Child Care / Preschool | $1,350.00 |

| FCC | Family Child Care | $1,830.00 |

| GCH | Group Care Home | $1,830.00 |

| BAS | Before / After School Programs | $320.00 |

| A+ | A+ Programs | $320.00 |

Providers can also receive additional funds for staff retention efforts. The formulas for the awards are as follows:

| Tier 1 - $3,500.00 per employee | Tier 2 - $2,000.00 per employee |

|---|---|

| Director | Aide |

| Teacher | Substitute |

| Assistant Teacher | Director (BAS service) |

| Lead Caregiver (Infant/Toddler Center) | Program Leader (BAS service) |

| Caregiver (Infant/Toddler Center) | Assistant Program Leader (BAS service) |

| Family Child Care Provider |

*Employees approved through a DHS waiver to be a teacher or teaching assistant will qualify for the Tier 1 award.

Any unclaimed or unexpended funds at the end of the program will be re-distributed to eligible providers.

Upon application approval, funding awards will be processed and distributed by the Public Consulting Group (PCG) directly to the payment information provided via direct deposit. Awards will be disbursed in two separate payments, as outlined in the table below. All funds should be spent by October 24, 2024.

| First Payment |

|

May 2024 |

| Second Payment |

|

June 2024 |

Reporting Requirements

All grant recipients are required to submit documentation for all spending, which should be uploaded throughout the grant period in the application portal.

All grant recipients are also required to complete a DHS Final Report in the application portal by November 14, 2024.

More information on federal reporting requirements will be available soon.

Visit the Additional Resources page to download the Supplemental Child Care Fund Expense Worksheet tool - here. This tool is designed to help providers keep track of expenditures.

Additional Disclosures

Additional Terms and Conditions for all applications are located here. When you submit an application, you agree to these Terms & Conditions , so please make sure you read them before you apply. Here are some additional details about the funding source for this program:

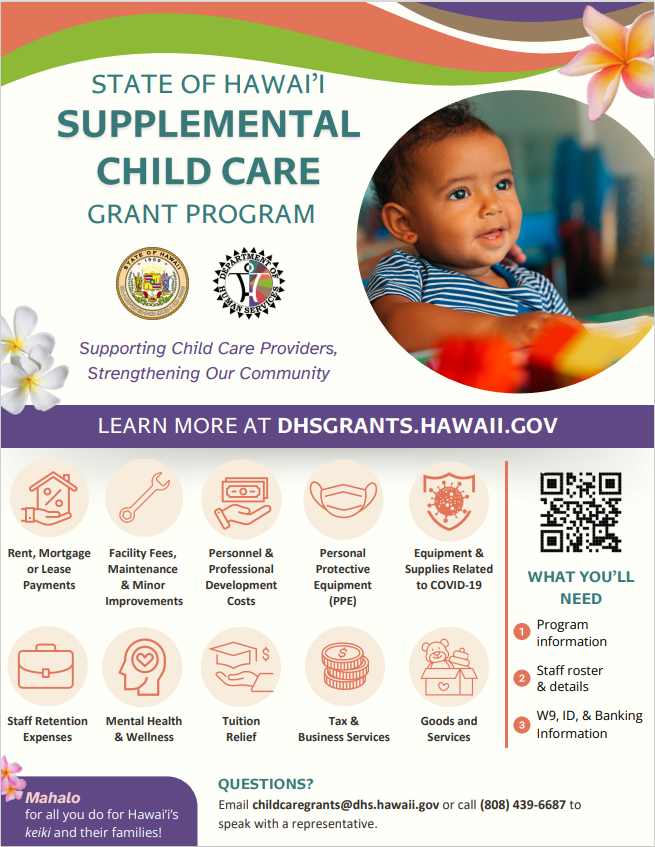

Informational Poster

PDF